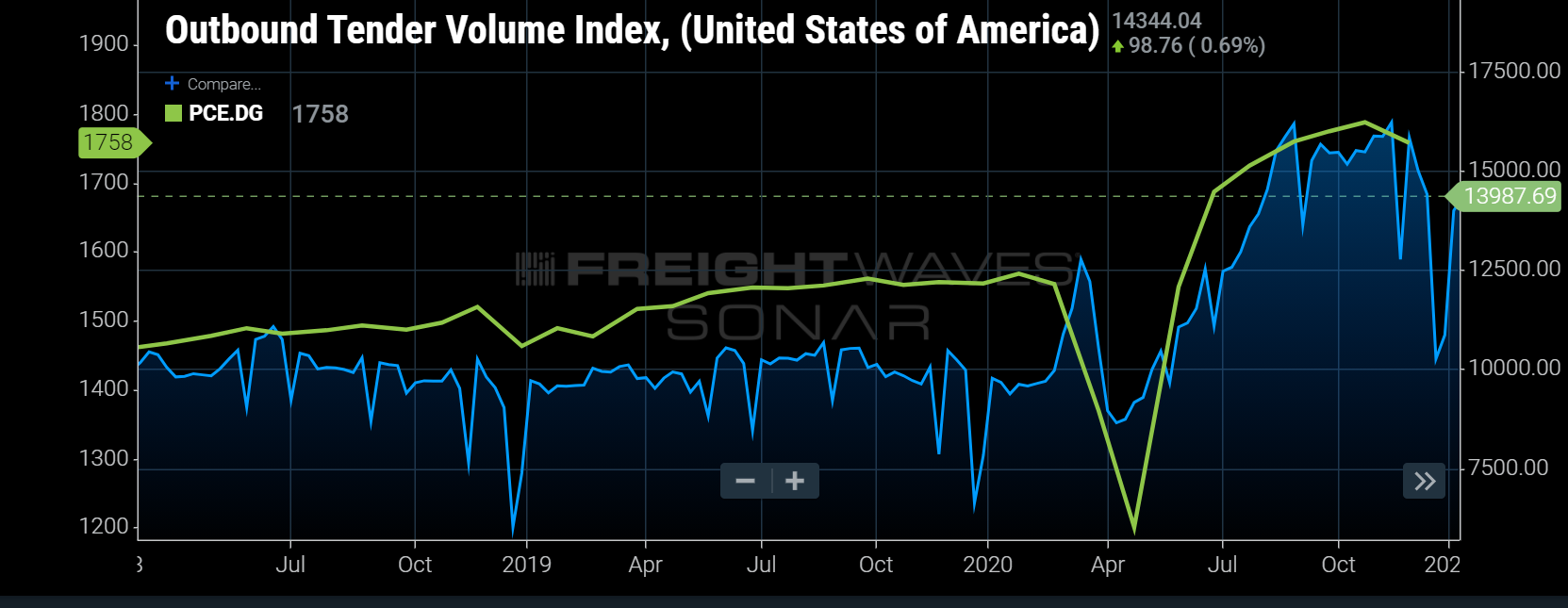

Consumer spending on durable goods expanded dramatically in the second half of 2020, showing a significant connection to FreightWaves’ national Outbound Tender Volume Index (OTVI). Prior to the pandemic, this connection was not as clean thanks to a healthier mix of manufacturing and industrial activity. The biggest question now is what happens if and when this spending recedes? First, let’s define personal consumption of durable goods to put it in context.

Personal consumption expenditures for durable goods measures spending on products such as appliances and furniture. Durable goods spending accounted for 13% of total consumer spending in the U.S. in 2019. Spending on nondurable goods such as food and clothing accounted for 23%, while services spending was the bulk at 64%.

Over the past three years, durable goods spending has fluctuated. In 2017 annual spending grew 4.5% year-over-year and in 2018 it grew over 5% per month, while 2019 saw it slowing back to 3.5% on average. From June through November 2020, spending on durable goods averaged nearly 13% annual growth each month.

Trucking tender volumes, measured by the OTVI, also saw an unprecedented increase in 2020, jumping 46% from Memorial Day to Labor Day. The OTVI accounts for both accepted and rejected tenders and is designed to show the quickest changes to truckload demand and not necessarily a good proxy for loads moved in a tight market like the current one. Taking rejected tenders out of the index, accepted volumes increased nearly 13% from Memorial Day to Labor Day, averaging over 21% higher than the previous year.

There is not a one-to-one connection between personal consumption and freight volumes. Nondurables like food and clothing as well as unfinished goods and construction materials make up a decent portion of volumes in the U.S. The industrial sector, largely thought to fuel freight volumes in the past, is still recovering from the initial hit that occurred this past spring.

Freight volumes tend to lead consumption as companies order inventory in front of expected demand.expected demand. Unlike capital goods and larger equipment orders, most durable goods are stored in warehouses and available for immediate distribution upon sale. Consumers have grown accustomed to quick fulfillment times over the past decade and companies with long order cycles risk missing out on sales.

In 2020 there was a combination of fulfillment and pull forward as companies struggled to maintain inventory levels for many of the goods thanks to the unexpected jump in consumer spending and production loss due to the virus. With transportation capacity becoming exceptionally tight and sourcing problems on the rise, there was also the need to order more than currently needed to make sure there were no missed sales opportunities.

Once the pandemic subsides, consumer spending on durable goods is expected to fall as more money is spent on services. Some of this should be offset as the industrial sector increases activity, but the sense of urgency that has pushed transportation rates to new highs is typically not as applicable to this type of freight.

Volumes may survive the reduction in consumer spending on durables, but the existing tightness will inevitably subside as the retail freight gives way to other types. Import volumes are expected to remain strong in the near term, but there are still many questions around consumer spending patterns as case counts decline.

Preparing for a gradual return to normal as temperatures warm may be the best strategy. Cases seem to decline in the warm season and a vaccine will help accelerate this. The U.S. economy depends on services to be healthy and this current environment, though good for many trucking companies and retailers, is not sustainable in the long run. The government cannot continue to print money to keep everyone apart.

It would be hard to imagine the current tight transportation market persisting throughout the year. Transportation spend would cannibalize budgets, forcing shippers to reduce costs in other areas and inevitably leading to a rapid decline in freight volumes. All parties should be expecting a moderating trend on the goods side this year, to say the least.

Read the full article at Freight WavesFreight Waves